How Much Can I Spend in Retirement?

Let’s take a break from taxes for a moment and talk about something fun… spending money! How much can I spend in retirement?

Taxes are often a retiree’s largest expense, but this expense is tied to how much money you need to live on in retirement. That is, the more you spend, the more you will own in taxes. In general.

After all, retirement is all about converting your assets (“saved income” or “deferred spending”) into a stream of income that you can use for the rest of your life.

So how much can you spend in retirement?

How Much Can You Spend in Retirement

Old fashioned estimates of how much you will spend in retirement are useless. For example, not infrequently you hear that you need to replace a certain percentage of your income, say 70-80%. What rubbish!

In order to get a nest egg as nice as yours, you either earned a lot or saved a lot, or both. For those who spend most of what they earn, spending and income are closely matched. For those who have over-saved for retirement, the correlation between spending and income is poor.

So, how do you estimate how much you are going to spend in retirement? After years of setting money aside for the future, the future is now!

What are Your Expenses In Retirement?

Well, what are you expenses in retirement? We already talked about a rather large one, namely taxes. Ironically, people not infrequently forget to account for taxes in retirement. We have already talked about How To Minimize Taxes In Retirement.

What are your other expenses? Are they constant? Or, are retirement expenses like a “smile?” Or perhaps rather “lumpier” than that? There are unexpected expenses that pop up from time to time, but first, let’s consider the retirement spending smile.

The Retirement Spending Smile

The retirement spending smile loosely describes overall spending in retirement. The idea is that spending gradually decreases during retirement, especially on fun things (variable expenses). Of course, if you live long enough, there will be increased spending late in life on medical and personal care expenses.

Spending is not flat over your whole retirement. It changes depending on age and other circumstances. Circumstances often dictate the lumpy expenses, but baseline spending changes over time as well.

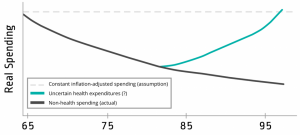

Find the retirement spending smile above. This smile demonstrates real spending over time. Real spending means you take inflation into account.

That is, even with inflation, the real spending seen in the smile actually decreases over time.

The dotted line along the top represents what you would actually spend if you increased yearly by the amount of inflation. When you factor in just non-healthcare spending (the black line), the line drops slowly over your first couple years of retirement (sometimes called the Go-Go Phase). The decrease in spending slows down some in the middle years (the Slow-Go Phase) and it flattens to just essential expenses during late retirement (delightfully described as the No-Go Phase). The initial downward slope in non-healthcare spending is more rapid initially and slowly flattens over time.

Health expenses, however, occur later in life. These expenses are unpredictable and variable, but occur with some certainty in late retirement. No-Go, except to the doctor, that is. In addition, insurance usually covers some of these expenses. More on that later.

How Much Can I Spend According to the Retirement Smile

When taken together, the decrease in non-healthcare spending and late increase in health expenses form a retirement spending smile.

This smile has several implications.

First, you often spend the most early on. Next, you need to save some for the increase in spending that is common late in life.

Finally, take note that affluent retirees have a different smile curve than those with limited resources (such as just social security). Those who over-save for retirement and have plenty of reserves actually rapidly decrease the rate of spending in early retirement. They also, as a percentage of real spending, hit a lower baseline that is flat for a longer period of time. And finally, those with retirement resources don’t see a healthcare spike near as often, possibly due to having greater reserves.

What does this mean for you, the well-to-do retiree? How much can you spend in retirement?

Not infrequently, folks who have earned quite a bit of money during accumulation don’t have a strict budget in retirement and can spend freely.

In accumulation, one frequently hears “pay yourself first.” After that, you can spend the rest freely. In retirement, a similar plan (or lack of plan) is also acceptable.

Do you need to know exactly how much you are going to spend in retirement? No! A rough guess at how much you want to spend the first year of retirement is often sufficient. If that number is in the same ball park as the 4% Rule and Monte Carlo Simulations are ok (which we talk about later), then you are good to go! It is nice to have built some reserves.

How Much Can I Spend in Retirement – Lumpy Expenses

But clearly, there are unexpected expenses that pop up during retirement that affect how much you can spend in retirement. How does one account for those? That is, what are lumpy expenses and how do they affect retirement spending?

Lumpy expenses are also called retirement spending shocks. These are mostly variable expenses, as in they don’t occur every year. They are either known or unknown.

Known lumpy expenses, for example, include automobile purchases, vacations, and routine but unscheduled home issues such as new HVACs and roofs. One could assume that common uninsured health expenses, such as dental and hearing aids also fit into the known lumpy expenses. For the most part, you can plan on these expenses and schedule them into your “budget.”

Unknown limply expenses, on the other hand, are really what we call retirement spending shocks. These are rather less predictable. Spending shocks include: unexpected health care expenses (major medical issues), family expenses (like failure-to-launch children and aging parents), divorce, and last but certainly not least, the loss of a spouse. Loss of a spouse is probably more predictable than most other things on this list, and some may be surprised that it is listed as an expense. There is a chapter on the Widow/Widower Penalty to explain the concept.

Lumpy Expenses in Detail

Let’s discuss some lumpy expenses in more detail.

Healthcare

- Healthcare, after running out of money, is often the largest concern for retirees. As you know, the healthcare system is broken, and a major issues is the lack of price transparency. From surprise out-of-network charges, to catastrophic illness or ambulance/helicopter bills that aren’t covered, you never know when you are going to need to reach into your billfold or purse to pay medical bills. However, above a floor, healthcare costs can be deducted from your income. This is a slightly confusing topic, and it doesn’t help that the IRS changes the floor now and again. But the important thing to understand about healthcare costs is that they are a mitigated risk.

- You have insurance after all. When spending shocks do come from health care costs, they usually are a deduction on your taxes. So, while healthcare costs are a frequent cause of anxiety and a common cost of spending shocks, the presence of insurance and the tax deductibility often mitigates the blow.

Long-Term Care

- Chances for lumpy expenses are moderately high with long term care concerns. Almost everyone will need some help if they live long enough. Statistics, however, are misleading, because most of the care needed and provided is not sufficient to unlock the benefits of long-term care insurance. Long-Term care insurance is a real conundrum in retirement planning, and I will dedicate future blogs to the topic.

Housing

- The money pit. Major housing expenses are common lumpy expenses. Home retrofits for medical issues are also of concern.

Travel

- This is a good lumpy expense! Take the cruise around the world.

Gifts

- Supporting kids, grand kids or parents with gifts can be lumpy expenses. Is your daughter’s wedding considered a gift?

Pet Emergencies

- Pets are important for psychological health and can be expensive!

Loss of a Spouse

- Spousal loss is inevitable but the timing is uncertain. Becoming a widow or widower has huge financial ramifications which are not often considered when making a retirement spending plan. Usually, there is loss of a social security check and perhaps part of a pension. Your tax rate increases as a single filer. There are, of course, emotional implications that are paramount

Consumption Smoothing and How Much You Can Spend in Retirement

So, what did we learn about lumpy expenses in retirement? There will be lumpy expenses! Consider the idea of “consumption smoothing.” This is a concept whereby retirees seek to have consistent spending over the years.

This is ideal from a tax planning perspective, as you likely have an optimal amount you need to pull out of your pre-tax retirement accounts every year.

In order to prevent sequence of return risk or inopportune withdrawals from your pre-tax retirement account, a cash buffer of 2-3 years is good common sense for the wealthy retiree. Yes, there will be some cash drag as you will not earn much money on your money market accounts and CDs. But a good retirement plan mitigates common risks, and you can be sure you will have spending shocks during your retirement. Retirees don’t need an emergency fund, but a cash cushion is nice to have.

How Much WILL YOU ACTUALLY SPEND in Retirement

Some find it difficult to start spending in retirement after decades saving. It is frequently difficult to know how much you are going to spend in retirement. Just pick a number that seems right and go from there!

You needn’t overthink this, because you have plenty. Downturns in the market will happen, as will spending shocks. But get over the idea that you will spend the same or more year after year in retirement.

Often times, a formal financial plan shows spending increasing with inflation year after year. That’s not how life works, as we see with the spending smile. Plan on spending a lot of money while you can. Spending will naturally slow down as you do to. It is wise to have some in reserve for the latter years, but otherwise plan for liberal spending in early retirement.

Pingback: How to Create Retirement Income - DIY Retirement Hacks

Pingback: What are the Risks in Retirement?