How to Minimize Taxes in Retirement

Saving money in retirement means that we need to consider taxes. Unfortunate as it is, taxes are not infrequently a retiree’s largest expense. How do you minimize taxes in retirement?

Remember the name of the game is to pay the least in taxes over your whole life. Saving on taxes in this calendar year pales in comparison to saving your heirs hundreds of thousands of dollars. So actually, the name of the game is to pay the least in taxes over both yours, your spouses’, and your heirs’ lifetime.

How to Minimize Taxes in Retirement? Consider using your tax planning window!

Using the Tax Planning Window to Minimize Taxes in Retirement

For the tax savvy individual, The Tax Planning Window is a glorious time. There is no other period in time where you have such control of how and when you recognize income. During this period, you decide exactly how much you are going to pay in taxes. A window is a good analogy because it opens and closes.

Open

The window opens when you retire and no longer have income. In years where you have no income, you can, for example, choose to recognize income by taking withdrawals from pre-tax retirement accounts. Since ordinary income fills up the tax brackets from lowest to highest, you can recognize quite a bit of income before you pay any significant taxes. Indeed, you can fill up your entire standard deduction (or itemized deduction) with sources of ordinary income and pay zero in taxes. Next, you need to fill up your lower tax brackets before you get to your higher tax brackets.

Close

The tax planning widow closes in a couple different ways. First, when you take social security, you will pay taxes on up to 50 or even 85% of social security depending on your “provisional income.” As a wealthy individual, just assume that 85% of your social security will be pulled into your taxable income. This alone can fill your standard deduction and some of the lower tax brackets.

Second, your tax planning window closes when you are forced to take required minimum distributions at age 72.

Finally, other sources of income must be recognized as ordinary. Pensions and annuities are common sources of partially (say annuities from your taxable brokerage account) and fully taxable income (pensions, and annuities from tax-deferred accounts).

An Aside: Box Retired Minimum Distributions

Required Minimum Distributions (RMDs) are the yearly amount you are required to withdrawal from your retirement accounts. When you or your employer save pre-tax money in retirement accounts, you get a tax write off in that tax year. Remember, though, uncle Sam is your silent investor in those accounts and he wants his money back. Currently, RMDs start at age 72 and increase yearly as your life-expectancy decreases. At 72, you are required to take out about 4% from these accounts. This increases to about 5% at age 78 and 10% at age 90. Also remember these accounts are deferred income, so you always pay ordinary income taxes on withdrawals from pre-tax retirement accounts.

Tax Planning to Minimize Taxes in Retirement

Why is Tax Planning so Important? Control.

Yes, you can control how much you pay in taxes. Not only this year, but for years to come. Remember, that you are forced to take out income in the future through Required Minimum Distributions. If you can recognize that income now at lower tax brackets, you have less to pay taxes on in the future.

I know this may be difficult for some to imagine. Why would I want to pay taxes now? This mindset is typical for the accumulator who has put together a good sized nest egg, especially through tax-deferred retirement accounts. The mantra early on in life is defer, defer, defer. Well, you are going to pay the tax man at some point, why not try to control when and how much you pay?

For a traditional retiree who retires at 65, you have less than 7 years to access your low tax brackets. Then, RMDs kick in and fill them up. You need a plan to optimize your tax future!

Control your Taxes in Retirement

For folks who retire earlier than 65, you not infrequently have a decade or more to tax plan in order to minimize taxes in retirement.

If you have saved a lot of money in tax-deferred accounts, you likely will have an RMD problem where you are forced to take out more money than you want to in the future. When this happens, you pay extra taxes on the extra amount that is more than you need, all at your highest marginal tax bracket.

So, you have control and flexibility. What do you do if you have an RMD problem in the future? It depends on your retirement plan.

If you need the money to live on between stopping work and RMD age, you may be best off withdrawing the perfect amount every year from your pre-tax retirement accounts. Just fill up the lowest bracket with the money you need anyway in order to live. Or, if you have money outside of your retirement accounts, the tax planning window is the perfect time to consider partial Roth conversions.

Minimize Taxes in Retirement Visualized

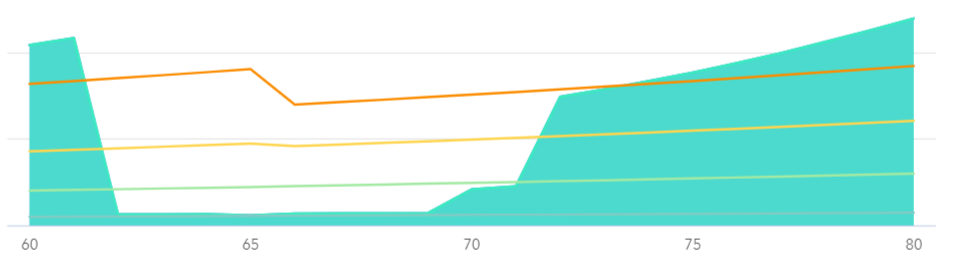

Figure 1

Above in figure 1, you can see a stylized version of the tax planning window. The blue represents income and it is reflected against the background of the different tax brackets. Note in figure 1 that income stops at retirement (age 61). The brackets are demonstrated by the colored lines. You can see once you hit retirement, taxable income drops way down. Then, there is minimal income in the example until social security starts at age 70 in this example. At age 72, RMDs begin and impede tax planning. Note that with RMDs, you quickly fill up the bottom brackets are are forced to pay taxes at higher tax brackets as the years go by, as you are forced to gradually increase your yearly distributions.

After retirement, and before RMDs, you have access to lower tax brackets. This is your opportunity to do tax bracket arbitrage.

Tax Bracket Arbitrage to Minimize Taxes in Retirement

Would you pay a dime now to save a quarter later? Maybe! It depends on how much later, as money is worth more now than in the future. This is called the time-value of money, and is important to understand. When paying taxes, however, it is important to realize that you are going to pay at some point. So why not optimize your taxes over your lifetime? If you withdrawal money now from your pre-tax retirement accounts at, say, 10 or 15% taxes, that then prevents you from paying taxes at, say 25 or 30% in the future. You can use tax bracket arbitrage to your advantage where you lock in low taxes now in order to prevent paying more in taxes in the future.

When?

Pay now or pay later… how do you decide? Well, you need to do a tax projection which can be rather tricky. Who knows what tax rates will be in the future. For example, back to figure one, you see the top tax bracket changes at age 66 when the Tax Cut and Jobs Act is due to expire in 2026. There is certainly legislative risk when considering future tax brackets. Politicians can and will change the tax brackets. Consensus is, however, that tax rates will be higher in the future rather than lower, as we are at pretty darn low tax rates currently.

When doing a tax projection, a spreadsheet or planning software is necessary. A DIY can do some minimal estimations of future tax liability, though, with some simple calculations. Look at the size of all of your pre-tax retirement accounts, and grow them by 4-6% a year until you are 72, 80, and 90. Then, look up how much you will need to take out those years through RMDs. That’s a lot of money you will be forced to pay taxes on! Is it more than you need? If you need that much money to spend anyway given your spending goals, it may not be that big of a problem. But if you have more pre-tax money than you need, it may be time to consider optimizing tax bracket arbitrage during your tax planning

Pingback: What are the Withdrawal Strategies in Retirement?