Retirement Withdrawal Strategies

Retirement Withdrawal Strategies: turn your assets into income while mitigating known risks.

Notice there are two components to this strategy. First, create income. Second, mitigate risks.

You get income from your assets, and you control risk with your product allocation. What is product allocation? We shall see!

How To Start Your Retirement Withdrawal Strategy?

Where to begin?

If you are using professional planning software, a Monte Carlo simulation and the 4% rule are good places to start. That is, as you are formulating a retirement plan, you want to make sure you are in the right ball park as you get started. You have your assets on one side, and spending on the other. If the Monte Carlo is 85% (or so) or better, then you might be able to keep working on your plan. Similarly, if you are around a 4% withdrawal rate once your last asset kicks in (usually social security at age 70 or RMDs at 72), then you might be fine as well.

We will have separate chapters on both Monte Carlo and the 4% safe withdrawal rate, but for now, just know that you need to check these boxes to start considering your retirement withdrawal plan. Life is, in actuality, not like the historical sequence of returns you see used in the 4% rule, nor is it like the thousands of simulated results you get from Monte Carlo. But you have to start somewhere.

What is next?

Your Actual Strategy in Retirement

What is the philosophy behind your withdrawal strategy and product allocation?

Remember that every decision you make is a tradeoff. Money earmarked for one strategy cannot be used again in another. This is very obvious when you purchase an income annuity, because the money actually leaves your balance sheet and is transferred to the general account of the insurance company!

But it is also true when you, say, want to earmark funds for possible Long-Term Care costs down the road. If you blow that money on an RV now, you no longer have a Long-Term Care plan!

Retirement, more than anytime in your life, is a time when you face a series of known (and unknown) risks. Products mitigate risk. A Retirement Plan is a plan to turn assets into income while addressing risks. So, there are two aspect to retirement planning, the income and the risks.

What proportion of your overall assets do you deploy towards income vs risk mitigation? This is your product allocation in retirement.

Folks who have undersaved really need to focus on delaying social security as their main income and risk mitigation strategy. There are no better alternatives!

Wealthy DIY retirees, on the other hand, tend to have more assets as their disposal, and plan to live significantly above the limited resources provided through social security. Most DIY are very familiar with their investments and have their asset allocation fine-tuned.

Products, however, are less familiar to the DIYer. They are in the realm of sales folks and often neglected. This is unfortunate, as we all have risks to mitigate.

When can you mitigate these risks on your own? What product allocation do you need and where can you get said products?

First, what is your strategy?

Safety-First Retirement vs. Investments

In terms of tradeoffs, one of the largest ones in the decision of safety-first vs stocks-first.

For safety-first proponents, it is reassuring to have 100% of your known fixed costs paid for in advance. You can get guaranteed payment from social security, pensions and commercial annuities. Of course, “guaranteed” can be debated in this context, but this is not the time to do so. Whatever is left over, can go to discretionary or legacy goals.

The flip side is the risk-based or investment folks who use withdrawals from their portfolio instead of a guaranteed floor. Their product allocation may just involve social security. This provides ultimate freedom and flexibility, but has a cost. Different Risks. And, as we know, the process of aging involves progressive mental incapacity. Think about the difference of a paycheck that does not end and arrives in your bank account once a month, or the need to log into a computer to sell equities and transfer the money into your account.

So, who are you? Are you averse to market risks and want to guarantee a floor of income that will last your lifetime? Or, are you ok with risk and the uncertainty of continued market, political, and even environmental threats on the certainty of your retirement nest egg?

If you have the assets, why not take care of both!

The Philosophy of Product Allocation in Retirement

So, who are you? Safety first and risk adverse, or investment minded and willing to let market risk persist in the golden years? As a DIY with adequate retirement reserves, it pays to be both.

What the philosophy of product allocation informs is that it is never all one or the other.

Just like with your asset allocation, you can be 100% stocks or 100% bonds. Such an extreme, however, is not right for most folks. And, in fact, product allocation—just like asset allocation—changes over time depending on your life circumstances and goals.

Retirement planning involves withdrawal planning and product planning. Retirement planning is not an either-or scenario. Remember, the goal is to spend your money and mitigate your risks.

Let’s look at product allocation in retirement

Product Allocation in Retirement

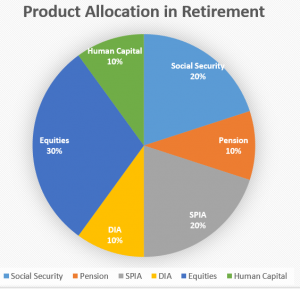

Next, I want to talk a little about product allocation in retirement. This may be a new term to you, and it likely comes from the insurance industry when they talk about ways to get you into expensive products. But I want to visualize your product allocation in retirement in a different way. But we can have a look at this from two perspectives. One, it answers the question “where does your retirement income come from” and second, it starts to talk about risk pooling vs probability-based plans. Let’s have a look.

Pie Graph of Product Allocation in Retirement

Let’s chat about the pie graph above. You have social security (which starts at 62-70 year of age), a pension, and two annuities: a SPIA and a DIA (or QLAC). I will talk about annuities below. Do not fear them, as they can add security to your retirement plan, though they are never strictly indicated for those who have over-saved.

Next, of course, there are stocks and bonds (equities) and human capital (ability to do work for income) as well. Not listed above are many other sources of retirement income, such as real estate, businesses, royalties, and other possible sources of income.

The point here; everyone has different sources of income in retirement. Withdrawal sequencing is different for everyone, and it depends on needs and mix of assets.

In summary, we have a product allocation of 10% human capital, 30% investments, and 60% products.

This product allocation can vary widely depending on your goals and risk tolerance. Product allocation, just like asset allocation, is very personal. No one should impose their will and tell you exactly what you need. No one is you.

What is the idea Ratio of Products to Investments?

In the pie graph above, there are investments and products. What is the ideal ratio of products to investments?

Like asset allocation, product allocation is an individualized decision. Much of it stems from the desire to floor your income vs the desire to leave a legacy.

DIYers have a significant proportion of their assets in investments, because they are still in an accumulation mind-set. This is actually perilous, as investments address a certain subset of risks more adequately than others.

When thinking about the ideal ratio of products to investments, if we are lumpers, we have safety-first vs investment minded folks.

Why do you need products? You don’t! Some people, however, want to hedge their bets a little. That is, you can pool your risk with other people and all come out ahead (or at least minimize the risk of really bad events).

Products usually mean insurance. Insurance products in retirement get a pretty bad name in retirement, but they don’t need to be feared. Don’t be sold these products; understand them and seek them out when they are appropriate. The main consideration is: do you want to face a risk alone or do you want to pool your risk?

What Products do You Need in Retirement?

Using a broad definition of products, everybody has at least one in their retirement. Social Security is a product. It offers a life-long, guaranteed, COLA-adjusted income stream that is useful for both income and longevity insurance. Social Security is an annuity, and there is no better product for longevity insurance in retirement!

What other insurance products should you consider to pool your risk in retirement?

-

Annuities –

There are income annuities that have mortality credits that are definitely worth considering, especially as a fixed income replacement. Don’t close your mind to the possibility of an annuity providing a lot of stability during your retirement. Do close your mind to expensive, complicated annuities that benefit the sales person more than you. You need to learn quite a bit about these products before your dip your toe in the water, and I have a whole chapter on them later in the book.

-

Life Insurance –

Most retired folks don’t need life insurance any more. If you already have cash value life insurance in place, it may be useful during retirement. More on that later. Term life insurance can be considered in product allocation for its death benefit. It is obviously more expensive to get term insurance the older you get. Permanent life insurance, on the other hand, does have a role for some retirees.

-

Home value –

A home equity line of credit can be important in the transition period between salary and full retirement. HECM (home equity conversion mortgage), or a reverse mortgage, is an underutilized product. Despite the stigma, there is a significant and important role these can play in retirement withdrawal planning. Don’t forget the value of cash flowing rental real estate in the retirement plan. This can be an important bond-like part of your income stream in retirement.

-

Traditional Pensions –

Important to decide on lump sum or income stream (annuitization) depending on the internal rate of return offered. This is relatively straight forward math but important! If you have a pension, consider it important as the “third leg” of the retirement stool (Social Security, Pension, and Stock/Bonds). Single life or with survivor benefits are an important consideration. Traditional pensions are becoming more rare as employers switch from Direct Benefit plans to Direct Contribution plans where the employee takes on the investment risk. If you have a pension, consider it gold.

-

Long Term Care Insurance –

Traditional Long-Term Care insurance is optimal for the wealthy retiree, but this is a complicated discussion. See Separate Chapter on Long-Term Care insurance for detailed information.

On the Other Side of Product Allocation

This is not an exhaustive list of products, but it is a pretty good start. What is on the other side of product allocation? The stock market and fixed income; that is, your investments. If you don’t want any products at all, you can consider a withdrawal strategy from your investment.

Stocks and bonds are hopefully most familiar to you. Likely, you have your asset allocation nailed down. What risk do you need to take to reach your goals? There are two sides to the risk discussion in the accumulation phase, how much risk are you willing to take (risk tolerance) and how much risk you need to take (risk capacity). Turning your asset allocation into income is an important retirement strategy to understand.

First, understand how to minimize taxes in retirement. All retirement planning, unfortunately, revolves around tax planning.

Next, understand spending in retirement. How much will you need?

And once you have your product allocation set and understand the ebbs and flows of retirement withdrawals, create your retirement income through an optimal sequence.

A DIY retirement will be a little complicated. But you can do it with some help and a few hacks along the way. Above are some retirement withdrawal strategies to consider

Pingback: Purpose in Retirement - DIY Retirement Hacks